A local partnership providing free virtual and curbside tax filing assistance to low-income residents is hosting its final event Wednesday before the April 15 filing deadline.

Residents from households earning less than $57,000 per year can drop off their tax documents and fill out a Tax Aid questionnaire. Volunteers will take care of the rest.

Curbside drop off will take place from noon to 2 p.m. at the Fair Oaks Community Center.

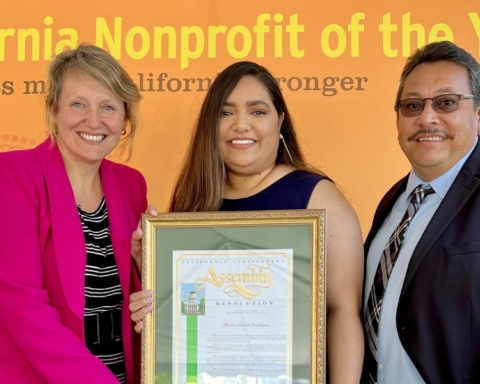

The program is hosted by Redwood City Together, CARON, and Cañada College, in partnership with Fair Oaks Community Center and Tax Aid.

Services are available both virtually and via curbside drop-off. To learn how to receive free virtual assistance, go here.

Whether done virtually or curbside drop-off, here are the documents required:

- Social Security Card or ITIN for each member of the family

- W2 & 1099 Forms from all jobs held during 2020

- Childcare Provider Info for children under 18

- A Voided Check for the account to deposit your refund

- Last Year’s Tax Return if you still have it

- Proof of Health Insurance – 1095-A and 3895 if you have them

Photo by Nataliya Vaitkevich from Pexels