While the clanking sound of construction near your home may not be easy to celebrate, an ongoing project to improve 7th Avenue in North Fair Oaks is a victory for county officials wanting to fund long-awaited road repairs.

Last month, San Mateo County touted the local construction as one of the first 10 projects in the county to be funded by Senate Bill 1 (SB1), which raised gas taxes and vehicle registration fees to fund a backlog of roadway repair and transit improvements statewide. The county’s statement came just a few days after an effort to repeal SB1 qualified for the November ballot.

In the face of a possible repeal, San Mateo County is among jurisdictions across the state exhibiting to the public how SB1 dollars are benefiting local communities. The effort comes as polls are “showing most California voters want to kill the new tax,” according to the Los Angeles Times.

In San Mateo County’s statement, Public Works Director Jim Porter said SB1 “nearly doubles the amount of money that we have for roadway maintenance and repairs.”

“Maintaining and repairing our roads has posed a challenge due to the limited funds dedicated to these projects,” said Dave Pine, president of the San Mateo County Board of Supervisors, who said residents will ultimately benefit from SB 1 funding.

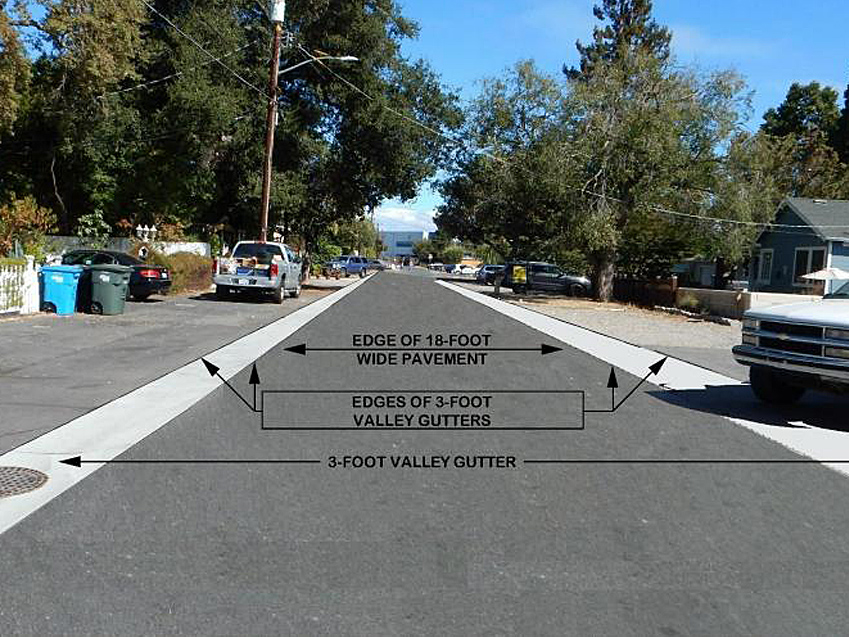

The new funding stream, county officials said, has helped address priority projects like 7th Avenue, which is receiving $1.5 million to fund improvements from Middlefield Road to Edison Way. The project’s construction, which began in May and is expected to be finished in August, includes repaving the street and installing concrete valley gutters and chicanes, among other work. You can receive regular updates on the project’s progress by clicking here. The other nine county projects to initially benefit from SB1 revenue include pothole repairs and maintenance work in La Honda, El Granada and Montara, and road improvements in Emerald Lake Hills, the San Mateo Highlands, Burlingame Hills and West Menlo Park, according to the county.

With SB1, the county says it will receive about $3.3 million in new revenue for the 2017-18 fiscal year and about $9.6 million in the 2018-19 fiscal year, which will be the first full fiscal year new gas taxes will be in effect.