Housing affordability “deteriorated” for all Californians last year, due in large part to double-digit home price growth during the COVID-19 crisis, according to the newly released data by the California Association of Realtors (C.A.R.).

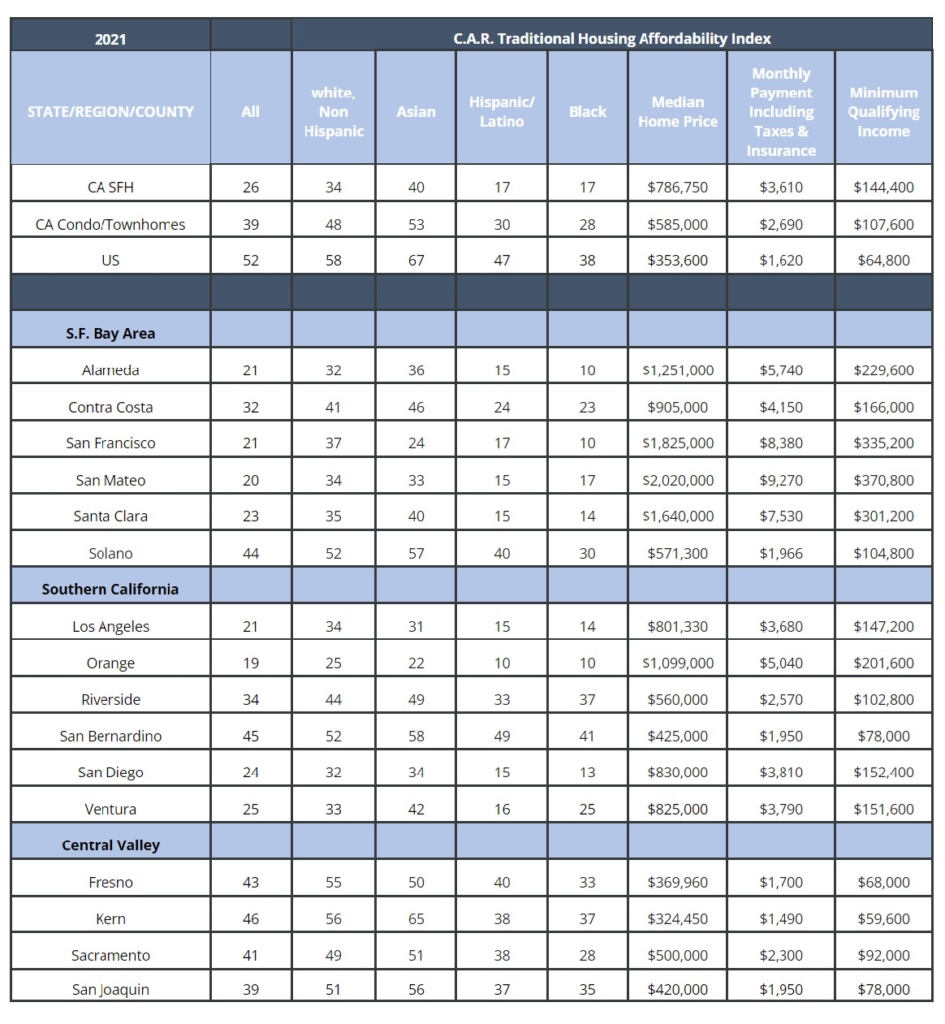

From 2020 to 2021, the number of Californians who earned the minimum income needed to afford the statewide median price for a single-family home dropped 2 percent to 26 percent, C.A.R. reported.

A household aiming to purchase a single-family home for the median price of $786,750 last year would have needed a minimum annual income of $144,400, said C.A.R. Assuming a 20 percent down payment with a 3.16 interest rate, monthly payments on that home would be $3,610.

C.A.R. noted a significant disparity in housing affordability for Black and Latino households. Statewide last year, 40 percent of Asian households and 38 percent of white/non-Hispanic households earned the minimum income needed to afford a median-priced home, compared to 17 percent of Black and Latino households.

The disparity is evident in San Mateo County, where the median price of a home was $2.02 million last year, higher than San Francisco’s (1.85 million) and Santa Clara’s ($1.64 million), according to C.A.R. While 34 percent of white/non-Hispanic households and 33 percent of Asian households in San Mateo County earned the minimum income needed to afford a median-priced home, the same was true for just 17 percent of Black households and 15 percent of Latino households in the County.

“The significant difference in housing affordability for Black and Latino households illustrates the homeownership gap and wealth disparity for communities of color, which could worsen as rates rise further in 2022,” said C.A.R.

C.A.R. President Otto Catrina noted how homeownership provides stability and economic security for working families. C.A.R. sponsored and helped pass laws last year that include mandated implicit bias training for real estate professionals, a bill to address appraisal bias and also bills designed to address supply and affordability challenges. The association is additionally providing closing cost grants of up to $10,000 to eligible first-home buyers from an underserved community.

“Promoting access to homeownership is one way to close the racial wealth gap and foster economic equity for all Californians, and that’s why C.A.R. is committed to addressing ongoing fair housing and equity issues that persist in our state that have made it harder for Blacks, Latinos and other underserved communities to access and afford housing,” Catrina said.

Photo by RODNAE Productions